Page 8 - NBIZ Magazine December 2020

P. 8

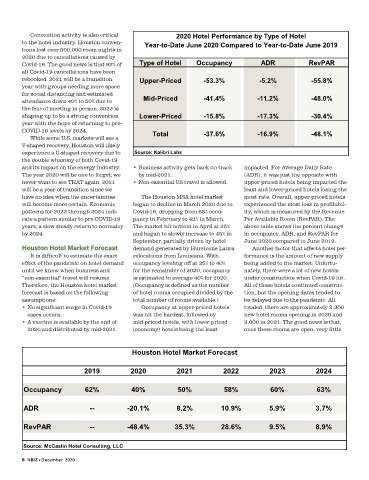

Convention activity is also critical 2020 Hotel Performance by Type of Hotel

to the hotel industry. Houston conven- Year-to-Date June 2020 Compared to Year-to-Date June 2019

tions lost over 500,000 room nights in

2020 due to cancellations caused by

Covid-19. The good news is that 92% of Type of Hotel Occupancy ADR RevPAR

all Covid-19 cancellations have been

rebooked. 2021 will be a transition Upper-Priced -53.3% -5.2% -55.8%

year with groups needing more space

for social distancing and estimated

attendance down 40% to 50% due to Mid-Priced -41.4% -11.2% -48.0%

the fear of meeting in person. 2022 is

shaping up to be a strong convention Lower-Priced -15.8% -17.3% -30.4%

year with the hope of returning to pre-

COVID-19 levels by 2024. Total -37.6% -16.9% -48.1%

While some U.S. markets will see a

V-shaped recovery, Houston will likely

experience a U-shaped recovery due to Source: Kalibri Labs

the double whammy of both Covid-19

and its impact on the energy industry. • Business activity gets back on track impacted. For Average Daily Rate

The year 2020 will be one to forget; we by mid-2021. (ADR), it was just the opposite with

never want to see THAT again. 2021 • Non-essential US travel is allowed. upper-priced hotels being impacted the

will be a year of transition since we least and lower-priced hotels losing the

have no idea when the uncertainties The Houston MSA hotel market most rate. Overall, upper-priced hotels

will become more certain. Economic began to decline in March 2020 due to experienced the most loss in profitabil-

patterns for 2022 through 2024 indi- Covid-19, dropping from 65% occu- ity, which is measured by the Revenue

cate a pattern similar to pre-COVID-19 pancy in February to 42% in March. Per Available Room (RevPAR). The

years; a slow steady return to normalcy The market hit bottom in April at 25% above table shows the percent change

by 2024. and began to slowly increase to 45% in in occupancy, ADR, and RevPAR for

September, partially driven by hotel June 2020 compared to June 2019.

Houston Hotel Market Forecast demand generated by Hurricane Laura Another factor that affects hotel per-

It is difficult to estimate the exact relocations from Louisiana. With formance is the amount of new supply

effect of the pandemic on hotel demand occupancy leveling off at 35% to 40% being added to the market. Unfortu-

until we know when business and for the remainder of 2020, occupancy nately, there were a lot of new hotels

“non-essential” travel will resume. is estimated to average 40% for 2020. under construction when Covid-19 hit.

Therefore, the Houston hotel market (Occupancy is defined as the number All of these hotels continued construc-

forecast is based on the following of hotel rooms occupied divided by the tion, but the opening dates tended to

assumptions: total number of rooms available.) be delayed due to the pandemic. All

• No significant surge in Covid-19 Occupancy at upper-priced hotels totaled, there are approximately 2,300

cases occurs. was hit the hardest, followed by new hotel rooms opening in 2020 and

• A vaccine is available by the end of mid-priced hotels, with lower-priced 2,000 in 2021. The good news is that,

2020 and distributed by mid-2021. (economy) hotels being the least once these rooms are open, very little

Houston Hotel Market Forecast

2019 2020 2021 2022 2023 2024

Occupancy 62% 40% 50% 58% 60% 63%

ADR -- -20.1% 8.2% 10.9% 5.9% 3.7%

RevPAR -- -48.4% 35.3% 28.6% 9.5% 8.9%

Source: McCaslin Hotel Consulting, LLC

8 NBIZ ■ December 2020